GE Vernova (GEV)·Q4 2025 Earnings Summary

GE Vernova Crushes Q4 as Orders Surge 65%, Stock Jumps 7% After Hours

January 28, 2026 · by Fintool AI Agent

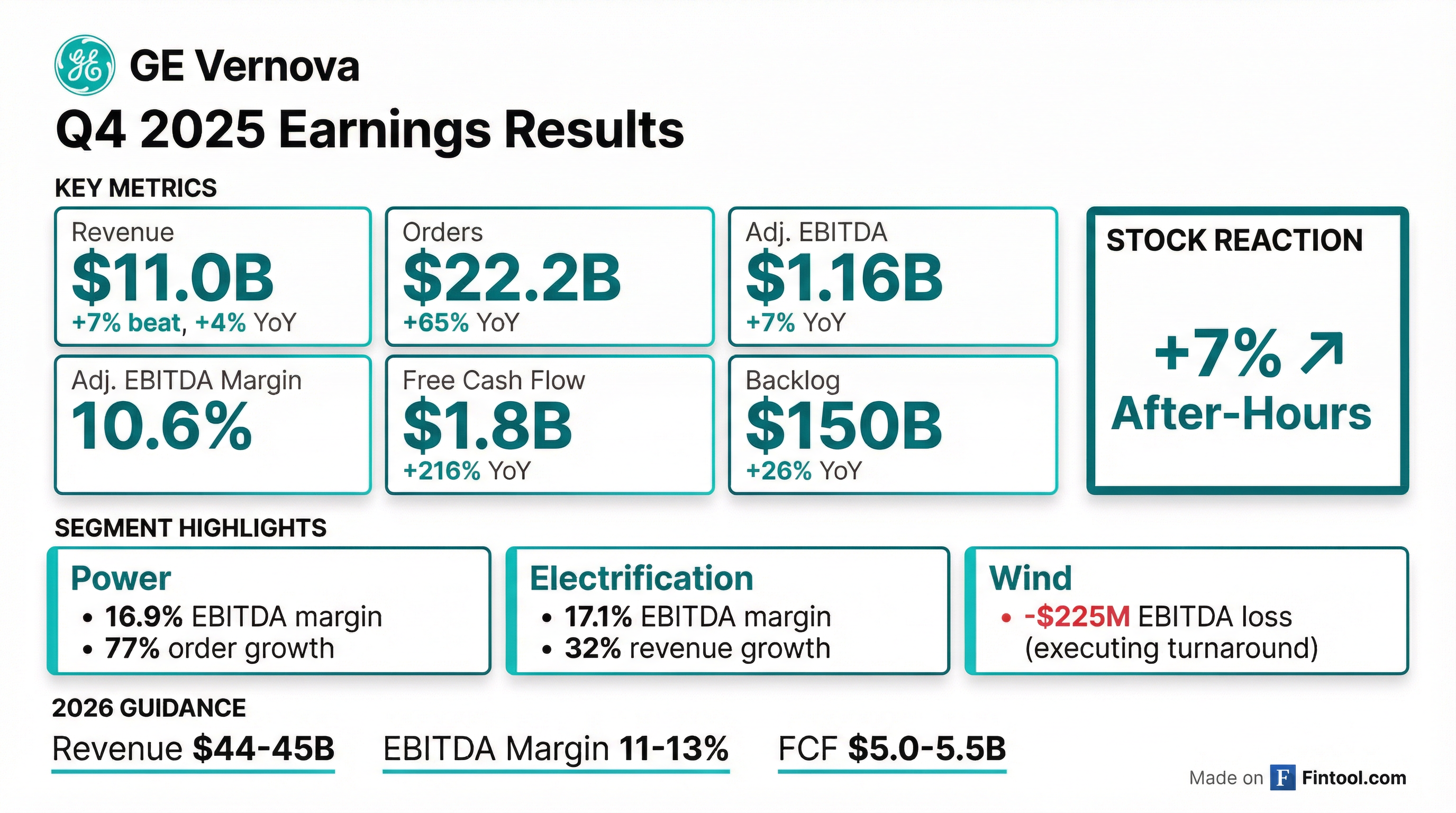

GE Vernova delivered a blowout Q4 2025, with orders surging 65% to $22.2 billion and revenue beating consensus by 7%. The energy equipment giant raised its 2026 guidance and outlined a path to $56 billion in revenue by 2028 with 20% EBITDA margins. Shares jumped 7% in after-hours trading to $742.

Did GE Vernova Beat Earnings?

Yes — revenue handily beat expectations while orders and backlog growth exceeded anything the market anticipated.

The revenue beat was driven by strength across Power (+5% YoY) and Electrification (+32% YoY), partially offset by continued Wind challenges (-25% YoY).

The EBITDA miss was largely due to higher Offshore Wind contract losses and investments to expand capacity, which management views as positioning for the future.

Full Year 2025 was the real story — GE Vernova delivered:

- Revenue of $38.1B (+9% YoY)

- Net income of $4.9B (inclusive of a $2.9B tax benefit from a U.S. valuation allowance release)

- Adj. EBITDA margin of 8.4% (up from 5.8% in FY24)

- Free cash flow of $3.7B, more than doubling from $1.7B

- $3.6B returned to shareholders through buybacks and dividends

What's Driving the Massive Order Growth?

Orders of $22.2 billion in Q4 alone were remarkable — that's 65% growth year-over-year and nearly equal to what many industrial companies generate in revenue for an entire year.

The backlog now stands at $150.2 billion, up 26% year-over-year. Equipment backlog alone increased $8 billion in 2025 with healthy margins locked in.

Why it matters: GE Vernova is securing capacity slots years in advance. Management noted that the majority of equipment orders from 2024/2025 won't deliver until 2027 and beyond, providing exceptional revenue visibility.

How Did Each Segment Perform?

Power: The Cash Cow Keeps Getting Better

Power delivered exceptional results with EBITDA margin expanding 200 basis points to 16.9%.

Gas Power continues to benefit from the data center buildout and energy security needs. In Q4, the company signed 24 GW of new gas equipment contracts — with an incremental 6 GW signed in the last three weeks of December alone — including 21 GW of slot reservation agreements and 3 GW of orders, converted 8 GW of existing slots to orders, and shipped 3 GW of equipment. Gas Power equipment backlog and slot reservation agreements grew from 62 to 83 GW — with equipment backlog increasing from 33 to 40 GW and slot reservations from 29 to 43 GW.

Management expects to reach approximately 100 GW under contract by year-end 2026, shipping high-teens GW while adding north of 30 GW in new contracts.

2026 Power Outlook: 16%-18% organic revenue growth with 16%-18% EBITDA margin.

Electrification: The Growth Engine

Electrification was the standout performer, with revenue up 32% and EBITDA margin expanding 410 basis points to 17.1%.

Orders were approximately 2.5x revenue, reflecting surging demand for grid equipment — synchronous condensers, substations, switchgear, and HVDC equipment. The backlog grew to $34.7 billion (+48% YoY).

2026 Electrification Outlook: $13.5B-$14.0B revenue (including ~$3B from Prolec GE acquisition) with 17%-19% EBITDA margin.

Wind: Still in Turnaround Mode

Wind remains the weak spot, with EBITDA losses widening in Q4 due to Offshore Wind contract losses and lower Onshore volumes.

Management is executing a controlled wind-down of underperforming projects. Both Offshore Wind projects in backlog are expected to complete, after which margins should stabilize. Services revenue grew 14% as the focus shifts to the ~57,000 turbine installed base.

2026 Wind Outlook: Revenue down low-double digits with ~$400M of EBITDA losses.

What Did Management Guide?

GE Vernova raised 2026 guidance from its December 9th Investor Day, incorporating the pending Prolec GE acquisition:

The Prolec GE acquisition (acquiring the remaining 50% stake for $5.275B) is now expected to close February 2, 2026 and adds ~$3B in annual revenue while strengthening GE Vernova's position as a global grid equipment leader.

By 2028 Outlook: Management outlined a path to $56B revenue (up from $52B prior) with 20% EBITDA margins and at least $24B cumulative free cash flow from 2025-2028 (up from $22B prior).

How Did the Stock React?

GEV shares surged 7% after hours to $742, following a 4% gain during regular trading to $692.70.

The stock has been on a tear, up from $252 at its 2025 lows to current levels — a nearly 3x return in just over a year. At $742, GEV trades at a market cap of ~$201 billion.

Valuation Context:

- Forward P/E: ~20x (based on FY26 estimates)

- EV/EBITDA: ~25x (based on 2026 guidance)

- Premium justified by: revenue visibility, margin expansion runway, energy transition tailwinds

What Changed From Last Quarter?

Key changes:

- Orders acceleration — Q4 orders of $22.2B were the highest quarter in company history

- Margin expansion — All three segments delivered margin improvement vs Q3

- Cash flow inflection — FCF of $1.8B driven by contract liabilities (customer deposits) increasing $5.6B

- Backlog quality — Equipment backlog margin expanded $8B in 2025

Capital Allocation: Returning Cash While Investing

GE Vernova returned $3.6 billion to shareholders in 2025 while investing heavily in capacity expansion:

- Share repurchases: 8.2 million shares at average price of $406, totaling $3.3B

- Buyback authorization: Increased to $10 billion (up from $6B)

- Dividends: Doubled to $0.50/share quarterly (from $0.25), payable February 2, 2026

- Capex: Investing $6B through 2028 (including $1B from Prolec GE)

- R&D: Investing $5B through 2028 for breakthrough energy technologies

Credit rating upgrades: In December 2025, S&P upgraded GEV to BBB (from BBB-) and Fitch upgraded to BBB+ (from BBB), both with positive outlooks.

Q&A Highlights: What Analysts Asked

On Gas Power Pricing Momentum: Analyst Joe Ritchie (Goldman Sachs) asked about pricing trends. CEO Scott Strazik confirmed that slot reservation agreements are priced 10-20 points higher than existing backlog, with pricing continuing to strengthen. By year-end 2026, management expects 100 GW under contract, with the split shifting to ~60% orders and ~40% SRAs.

On Competition from Smaller Turbine Makers: Analyst Julian Mitchell (Barclays) raised concerns about smaller players gaining share. Strazik was dismissive: "Frankly, a lot of the smaller applications are simply enabling more projects to get started... we don't really view those smaller units to be competition." He emphasized that heavy-duty turbines win on economics for 20-year base load operations.

On Capacity Sold-Out Timeline: Analyst Amit Mehrotra (UBS) asked about capacity availability. Management confirmed: 2029 still has available slots today, but by year-end 2026 when they reach 100 GW under contract, both 2029 and 2030 will be "largely sold out." Discussions are active for 2031-2035 framework agreements.

On Nuclear SMR Opportunities: Analyst David Arcaro (Morgan Stanley) asked about SMR deal pipeline. Strazik noted opportunities are "growing" but cautioned: "they're sequential... we're really restarting an industry here in the Western world." Active discussions ongoing in Sweden and Poland, plus with U.S. hyperscalers.

On Trump Administration Energy Policy: Analyst Nicole DeBlase (Deutsche Bank) asked about the emergency power auction announcement. Strazik was supportive: "There's clearly a need to continue to evolve the market mechanisms... whether that happens through the auction mechanism... or capacity auction mechanisms that provide more years of revenue guarantee." He noted the market is moving regardless — from 46 GW to 83 GW in 2025, with 100+ GW expected by year-end 2026.

Vineyard Wind Update: Force Majeure and Injunction

The U.S. government's December 22 stop work order on offshore wind projects created a setback for the troubled Vineyard Wind project. At the time of the order, GE Vernova had only 10 turbines needing blades and 1 turbine left to install out of 62 total.

Key developments:

- GE Vernova declared force majeure due to the government action, protecting against incremental costs

- January 27: Vineyard Wind received an injunction of the stop work order

- If given permission to resume soon, GE Vernova would work to complete by end of March 2026

- After March, the required installation vessel becomes unavailable — if the 11 remaining turbines can't be installed, 2026 Wind revenue could be negatively impacted by ~$250M

Management emphasized that due to contract loss accruals and force majeure protections, they "do not anticipate significant additional negative EBITDA impacts for the Vineyard Wind project beyond the amounts already recorded."

Operational Excellence: Key Metrics

Management highlighted several operational improvements during prepared remarks:

CEO Strazik also previewed emerging technologies:

- Solid-State Transformer: First unit completed, testing this summer, delivery to hyperscaler customer in autumn 2026

- Direct Air Capture: Facility "up and running"

- Fuel Cell Program: "Good technical progress" in Malta, NY

Risks and Concerns

-

Wind segment drag — Offshore Wind losses continue to weigh on results. Execution risk remains on completing troubled projects. The Vineyard Wind situation remains fluid.

-

Tariff exposure — Management estimates $300-400M net tariff impact, but escalation could pressure margins. Q1 2026 Wind EBITDA losses of $300-400M expected partly due to tariff impact on orders signed before protections.

-

Capacity constraints — Demand is outpacing ability to add capacity. Gas turbine deliveries won't reach 20 GW annualized output until mid-2026.

-

Execution on Prolec GE — $5.275B acquisition closes February 2, 2026. Integration must succeed.

-

Valuation — Stock has tripled; expectations are now elevated.

-

Nuclear timing — SMR investments are a current drag on Power margins; returns expected "in the next decade."

Key Management Quotes

On backlog growth trajectory — CEO Scott Strazik:

"Just over 4 years ago, we announced our separation from GE, and today, our backlog is 50% larger than it was upon the time of the spin announcement... Electrification generated about $5 billion in revenue in 2022, and we now expect that number to be $13.5 billion-$14 billion in 2026, and we are just getting started."

On margin expansion opportunity — CEO Scott Strazik:

"In totality, the equipment margin and backlog from 2023 to 2026, those four years will add at least $22 billion in equipment margin, driving future profitable growth."

On sourcing productivity upside — CEO Scott Strazik:

"Can we be even more effective with our sourcing leverage here now that we're at this level of scale... I think we've got a few miles still to go together. That is good news in the sense that it's opportunity."

On company culture — CEO Scott Strazik:

"I hope you can hear in our voices both a combination of humility and hunger that we have as we go into a new year, that there's a lot of work to do. We're ready to do that work."

Forward Catalysts

The Bottom Line

GE Vernova delivered a monster quarter that exceeded expectations on nearly every metric that matters. Orders surging 65%, backlog up 26%, margins expanding, and free cash flow more than doubling tells a compelling story of a company at the epicenter of the energy transition.

The raised 2026 guidance and path to $56B revenue / 20% EBITDA margins by 2028 provides a clear roadmap. Wind remains a work-in-progress, but Power and Electrification are firing on all cylinders.

Management's commentary on the call was notably bullish — they expect to add at least $8B more in equipment backlog margin in 2026, gas turbine pricing continues strengthening, and Electrification is outpacing its addressable market at just 10% penetration.

At $742 after hours, the stock isn't cheap — but premium businesses rarely are. The question for investors is whether the execution can match the opportunity.

Data sourced from GE Vernova Q4 2025 8-K filing, Q4 2025 earnings call transcript, and S&P Global. ll transcript, and S&P Global.* ta sourced from GE Vernova Q4 2025 8-K filing, Q4 2025 earnings call transcript, and S&P Global.*